Annual filing ensures the transparency in the working of the companies. Since it is a mandatory requirement, therefore, companies cannot hide its financial information. Annual filing provides various information of the company such as company’s business activities, capital structure, cash flow, liquidity and profitability, transactions with related parties etc.

What Forms are included under Annual Filing?

Under companies Act, there are only two forms, namely, AOC-4 and MGT-7 which are prescribed for annual filing. Both forms are filed online to ROC.

E-form AOC-4

This form mainly contains financial statements which include Profit & Loss Account, Balance Sheet and Cash Flow statements. All these statements reveal all financial information of the company.

This form is filed within 30 days of Annual General Meeting (AGM).

E-form MGT-7

This form used for filing Annual Return which contains both financial as well as non-financial information of the company which include directors’ details, various meetings held during the year, remuneration of Directors and KMP, shareholding pattern and so on.

This form is filed within 60 days of AGM

“Annual Return shall also contain a certificate as per Form No. MGT 8 duly authenticated by Company Secretary in practice in case of a listed company or a company having paid up share capital of Rs. 10 Crore or more or turnover of Rs. 50 Crore or more.”

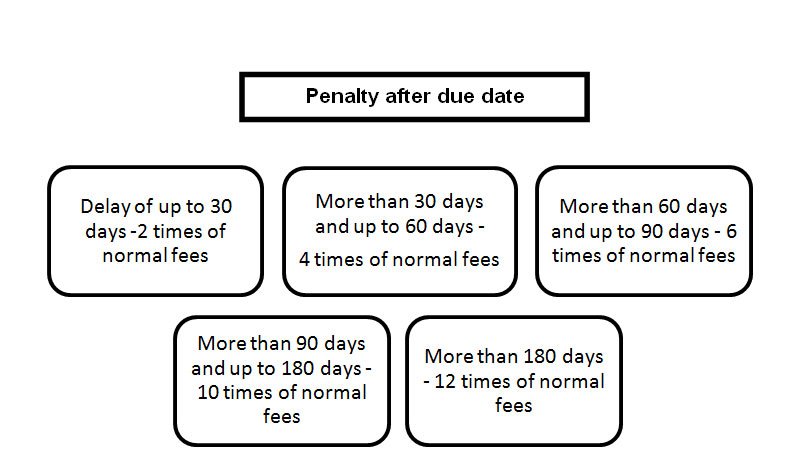

A company can also file e-forms AOC-4 and MGT-7 beyond 30 or 60 days as mentioned above with additional fees within 270 days which are as follows:

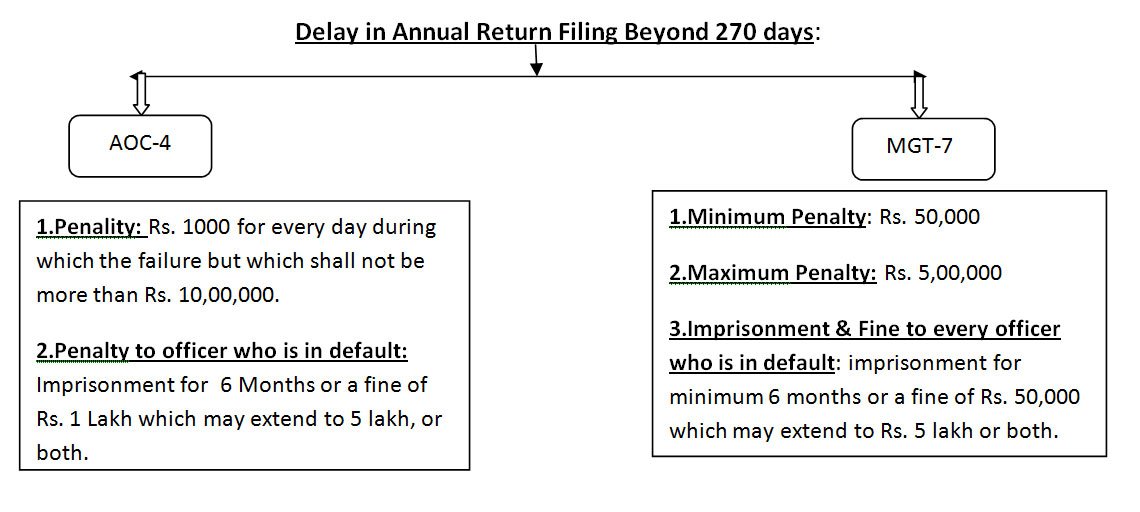

But if company is not able to file the same within 270 days, then company and every officer in default is penalised as follows:

BENEFITS OF ROC ANNUAL FILING

Reduce Penalty

Filling ROC forms on time will leads to save cost of penalty.

Proper Compliances

Proper filling on time can help in proper compliances of the company

Defaulting Status

By Filling ROC Form on time Company can maintain the status of Non Dormant / Active Company.

It contains information of balance sheet, profit & loss account & Compliance Certificate of the Company.

It also contain details of registered office, details of director, details of members, details of shares & shareholding of the Company.

| Authorised Share Capital | Amount |

| in respect of a company having a nominal share capital of upto 1,00,000. | 200 |

| in respect of a company having a nominal share capital of Rs. 1,00,000 or more but less than Rs.5,00,000 | 300 |

| in respect of a company having a nominal share capital of Rs. 5,00,000 or more but less than Rs.25,00,000 | 400 |

| in respect of a company having a nominal share capital of Rs.25,00,000 or more but less than Rs. 1 crore or more | 500 |

| in respect of a company having a nominal share capital of Rs. 1 crore or more | 600 |

| Period of delays | Forms including charge documents |

| upto 15 days (sections 93,139 and 157) | One time |

| More than 15 days and upto 30 days (Sections 93, 139 and 157) and upto 30 days in remaining forms. | 2 times of normal filing fees |

| More than 30 days and upto 60 days | 4 times of normal filing fees |

| More than 60 days and upto 90 days | 6 times of normal filing fees |

| More than 90 days and upto 180 days | 10 times of normal filing fees |

| More than 180 days and upto 270 days | 12 times of normal filing fees |