In case of Public Limited Company, Minimum three (3) and Maximum Fifteen (15) numbers of directors are required.

There is no minimum capital requirement is prescribed by the government.

There is no limit on maximum number of member; however minimum numbers of members are Seven (7).

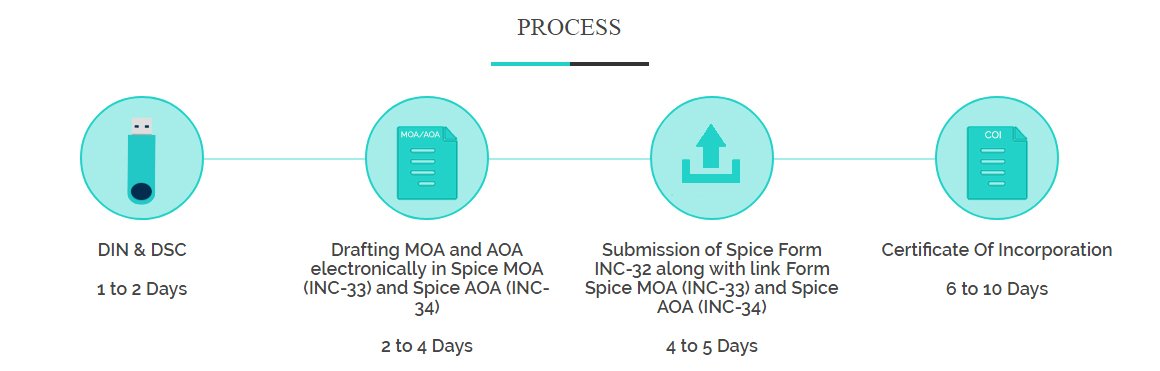

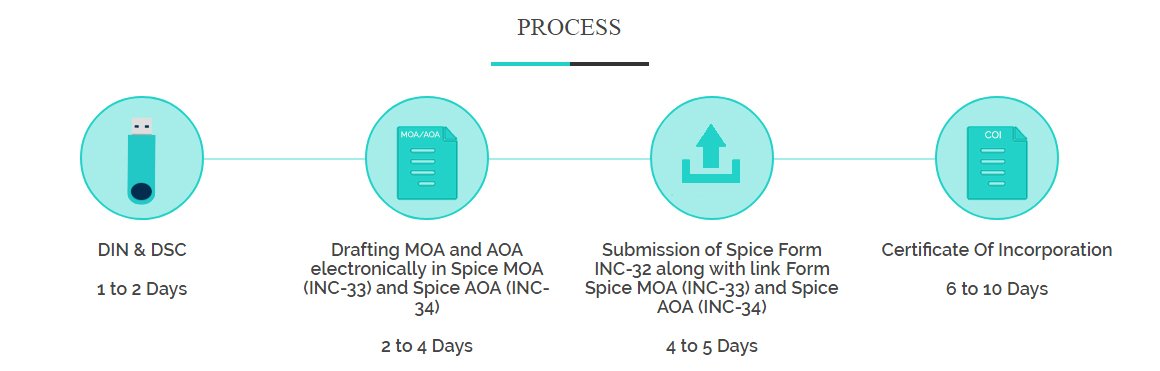

To incorporate a company we required approximately 10 to 12 working days. The time taken for incorporation will depend on submission of relevant documents by the client and speed of Government Approvals. To ensure speedy process of incorporation, please choose a unique name for your Company and ensure you have all the required documents are provided before starting the incorporation process.

Following are the documents required for company incorporation for each director/ shareholder

Self attested PAN card copy.

Four Photographs.

Self attested copy of any one of the Identity Proof like Driving License, Passport, Voter ID & Aadhar Card

Self attested copy of any one of the Address Proof like Bank Pass Book/ Bank Statement, Telephone Landline Bill, Mobile Bill & Electricity Bill

Company Address proof Electricity Bill, Telephone Bill, Mobile Bill & Gas Bill, AND Rent Agreement (if rented) AND NOC for doing Business & for taking Registration.

Digital Signature Certificate (DSC) as the name suggests it is a digital signature of an individual and it is required for filling the e-forms of company incorporation electronically to Ministry of Corporate Affairs.

Digital Signature Certificate (DSC) as the name suggests it is a digital signature of an individual and it is required for filling the e-forms of company incorporation electronically to Ministry of Corporate Affairs.

The Unique Number is required to allot to an Individual which remains valid for whole life of the individual and is required to become director of any company.

The Director required to be above 18 years of age and must be a natural person. He may or may not be citizen or residence of India. We can say that even foreign nationals can be Directors in Indian Public Limited Company.

The director has been entrusted with the responsibility of managing the company in the best efficient manner. The responsibility of a director depends upon the kind of directorship he holds in the company. For instance, an executive director or a managing director has greater responsibility than a non-executive director who might hold the directorship as an expert or consultant. A director is liable for misconduct or fraud or if found guilty of default.

Yes, subject to Foreign Direct Investment (FDI) Guidelines a NRIs / Foreign Nationals / Foreign Companies can hold shares of a Public Limited Company.

Firstly we just need to find a unique name as prefix and promoters need to provide name of the proposed company along with significance of word. Secondly the name needs to include a word about the company business activity. Finally before selecting Names it will be advisable to check on Google, MCA Portal, MCA Guidelines and Trade Mark site the availability of Name.

MOA & AOA of the company defines all the rules and regulations and the working flow of company. It also defines everything about the company’s objects, capital, identity, goals and working pattern. After the name of the company is select the Memorandum of Association and Articles of Association of the company is required to be drafted, the last page of the MOA and AOA is known as subscriber sheet which need to be filled in by the promoters in their own hand writing including their personal details and shareholding ratio.

Get the certificate of incorporation along with PAN & TAN within 6 to 10 days after uploading the Spice e-form INC-32, Spice MOA(INC-33), Spice AOA(INC-34) along with Form 49 A(PAN) and 49 B(TAN).

The Common Seal is the official signature of the company. Any documents on which Common seal is affixed, is deemed to be signed by the company.

A Company can own and enjoy property in its own name, neither the members are not owners of the company’s property and nor the members have insurable interest in the property of the company.

A Public limited company must get its statutory audit done by a Chartered Accountant at the financial year end and it also required to file Income Tax Return to Income Tax Department. In Addition to that a company also required to file its Annual Filling Forms with Registrar of Companies. Further the Public Limited Company must conduct Board Meeting atleast once in every 3 months and an Annual General Meeting, atleast once in every year and also maintain Minutes of every Board Meetings and General Meetings and Statutory Registers.