Digital Signature Certificate (DSC) as the name suggests it is a digital signature of an individual and it is required for filling the e-forms of company incorporation electronically to Ministry of Corporate Affairs.

The Director required to be above 18 years of age and must be a natural person. He may or may not be citizen or residence of India. We can say that even foreign nationals can be Directors in Indian Section 8 Company.

In case of Section 8 Company, minimum no. of director is two.

Yes, promoters need to be present to personally meet us at our office or meet at any place for the registration of a Company. All the incorporation documents required to be present in original and scanned copy also required to submit.

In case of Private Limited Company, minimum no. of members is two and maximum are two hundred.

In case of Section 8 Company, minimum capital required is Rs.1,00,000/-.

MOA & AOA of the company defines all the rules and regulations and the working flow of company. It also defines everything about the company's objects, capital, identity, goals and working pattern. After the name of the company is select the Memorandum of Association and Articles of Association of the company is required to be drafted, the last page of the MOA and AOA is known as subscriber sheet which need to be filled in by the promoters in their own hand writing including their personal details and shareholding ratio.

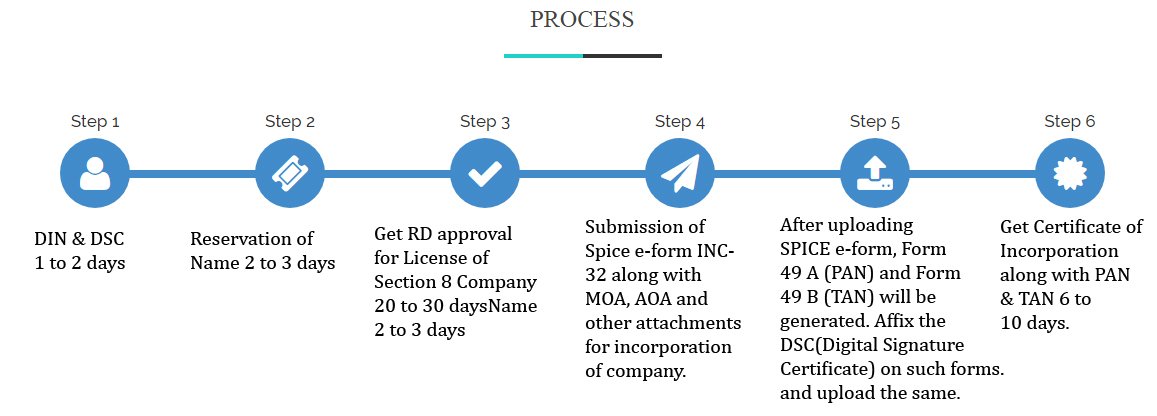

STAGE-1: DOCUMENTATION

Firstly provide all the required documents mentioned below.

STAGE-2: DIGITAL SIGNATURE CERTIFICATE (DSC – CLASS – II)

The Second stage is to Apply for DSC. DSC is required for filling the forms of company registration electronically to Ministry of Corporate Affairs. We obtain it from (certifying agencies.).

STAGE-3: DIN (DIRECTOR IDENTIFICATION NUMBER)

The Third stage is to apply for DIN. The Unique Number allotted to the Directors of the company which remains valid for whole life of the director and is required to become director of any company.

STAGE-4: COMPANY NAME AVAILABILITY

The Fourth stage is to apply Name of the company. Most Crucial aspect of company registration is the name approval of the company.

STAGE-5: DRAFTING OF MOA & AOA

The Fifth step is start after the name of the company is Approved the Memorandum of Association and Articles of Association of the company is drafted, the last page of the MOA and AOA is referred as subscriber sheet which need to be filled in by the promoters in their own hand.

STAGE-6: LICENSE UNDER SECTION 8 FOR NEW COMPANIES WITH CHARITABLE OBJECTS

A person or an association of persons desirous of incorporating a company with limited liability under sub-section (1) of section 8 without the addition to its name of the word "Limited", or as the case may be, the words "Private Limited", shall make an application in Form No.INC.12, INC 13, INC 14 & INC 15 along with the prescribed fee, to the Registrar for a license under sub-section (1) of section 8.

STAGE-7: CERTIFICATE OF INCORPORATION

If after filling the Requisite forms for incorporation with the Registrar of Companies along with fees, ROC is satisfied with the contents of the documents filed, ROC will issue the License in form No. INC.16 (Certificate of Incorporation) under section 8(1) read with rule 19 of Companies (Incorporation) Rules, 2014. Such company registered under section 8 shall enjoy all the privileges and be subject to all the obligations of limited companies.

Apply for PAN and TAN

Apply for Sales Tax / Service Tax Registration based on the nature of Business.

Filing ADT-1 for Appointment of First Auditor of the Company within 1 Month of Incorporation of Company and in case the Board fails to appoint such auditor, it shall inform the members of the company, who shall within ninety days at an Extra Ordinary General Meeting appoint such auditor and such auditor shall hold office till the conclusion of the first Annual General Meeting.

Filing Income Tax Return of Company on or Before 30th September every year

To maintain proper Books of Accounts

Get your account books Audited Every Year.